Accounting firm manager, save up to 87% on invoicing!

Make invoicing in an accounting firm fast with the help of an account practice management system

Koho PSA is an easy-to-use and flexible accounting practice management system, which takes care of the most important routines in your accounting business. With Koho PSA, accounting agencies can streamline their time reporting, time registration, management of recurring assignments, invoicing, and reporting.

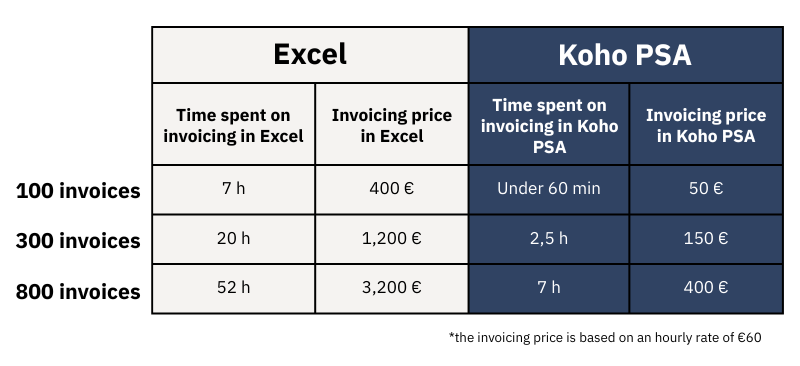

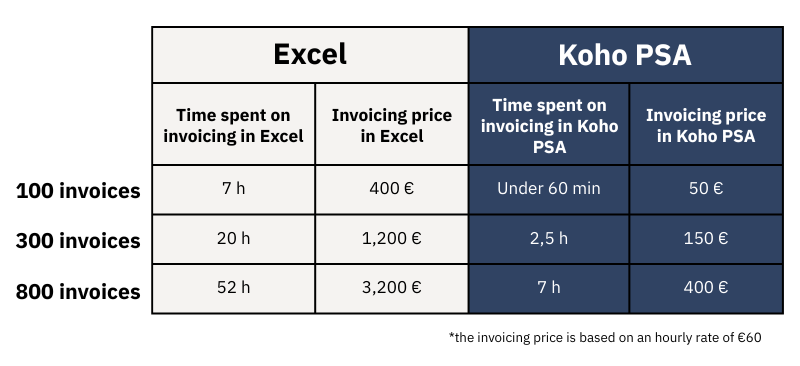

Invoicing with Excel vs. Koho PSA

The most common invoicing method in accounting firms is a combination of Excel and financial management systems. According to a study by Aalto University, 67% of professional services companies use this combination for invoicing. We had the opportunity to compare one of our client’s invoicing method, from Excel-based invoicing to invoicing through Koho PSA’s accounting practice management system. The comparison took into account the total time spent on invoicing for all invoices using both methods, and the result was striking. Invoicing with Koho PSA was 87% faster.

The difference in invoicing speed is due to Koho PSA automatically creating finished invoice lines according to rules. Koho PSA contains information about customers’ invoicing bases and prices. The system automatically prices time-reported work as it is registered. The completed invoice lines are then transferred to the invoicing view, where they can be adjusted if necessary before approval and invoicing. Contract invoicing and recurring invoicing can be fully automated with Koho PSA. Invoices only need to be approved for sending, or supplemented with time reports and products.

A well-structured accounting firm can create an invoice in just a few seconds.

Using an accounting practice management system streamlines everyday work in several ways. For example, an agency with 300 customers can reduce the time spent on invoicing by 17.5 hours per month compared to manual invoicing. This time saving can be directly converted into billable customer time, which can increase invoicing by over a thousand euros per month. The accounting practice management system also eliminates the risk of lost invoices and significantly reduces the time spent searching for information.

Weaknesses of Excel invoicing

Excel files are combined or stored on a server, which means there is a risk of information being lost or accidentally overwritten. In Koho PSA, work is automatically priced according to customer-specific prices, and the system creates ready-made invoices based on registered transactions. Invoices do not need to be created manually.

Invoicing documentation can be lost during manual data transfer between Excel and the financial management system. Koho PSA ensures that all invoicing documentation is always included in the invoice. Invoicing material cannot be deleted by mistake. In addition, information does not need to be registered in multiple systems, as invoices are transferred directly from Koho PSA to the financial management system.

Creating invoices from scratch or copying old invoices is time-consuming and increases the risk of errors. Koho PSA generates invoices automatically according to defined rules, or the invoicer can compile them based on various events and time registrations. This way, all work is invoiced correctly, and the risk of errors and forgotten invoices is eliminated.

Excel invoicing also does not provide comprehensive reports on customers, recurring assignments, or employees. Koho PSA offers real-time reports that help you manage your business, your clients, and your employees.

Want to hear more about Koho PSA? Book a free demo via the link below.

Would you like to have a better look?

Request a free demo!

Book a free demo, no strings attached, and let Koho PSA convince you. You can save up to 87 % in invoicing with Koho PSA. The demo will give you a better view on how Koho PSA will help your accounting company succeed.